Come Jan. 1, Oxford residents could see a significant increase in their property tax bills. The county auditor wants to ease the financial burden for residents, but not without a cost.

Earlier this year, 41 counties in Ohio underwent either a state-mandated triennial update, which happens every three years, or a full property reappraisal, which happens every six years. Butler County received a triennial update, and the Ohio Department of Taxation looked at the auditor values across the county and paired it with the sales in 2022. The results determined that the property taxes in Butler County were, on average, 37% below the market value.

“Then, they individually set other areas like West Chester Township, Liberty Township, City of Hamilton, City of Middletown,” said David Brown, communications manager for the Butler County Auditor’s Office. “They pull collectively a number for those as well to get to that overall 37%, and that changes depending on properties and areas of the county that might see more robust sales.”

To offset the steep increase in taxes for residents, Nancy Nix, Butler County’s auditor, is offering local government entities a proposal to collect the same amount of money they collected last year.

“Basically it’s not taking as much as they would be legally permitted to take in order to stay at last year’s funding level,” Brown said.

William Snavely, the mayor of Oxford, said the city council is aware of the proposal, but they have yet to make any decisions. While Snavely said resident finances will play a crucial role in the decision to accept the proposal, the extra money would be beneficial in helping out the Oxford Fire Department and EMS Services.

“I think it’ll be an interesting issue because Miami University does not pay their fair share for fire and EMS coverage,” Snavely said. “We’re trying to get Miami to pay their fair share, and even if they pay their fair share, we might still need a levy for the fire department, so the question becomes, would we take the increase in property taxes instead of the levy?”

Snavely said the university does not pay property taxes as a nonprofit organization, but other entities do pay property taxes and use the fire and EMS services. Oxford Township, Reily Township and Milford Township all pay something for their coverage of fire and EMS.

School districts face a similar dilemma

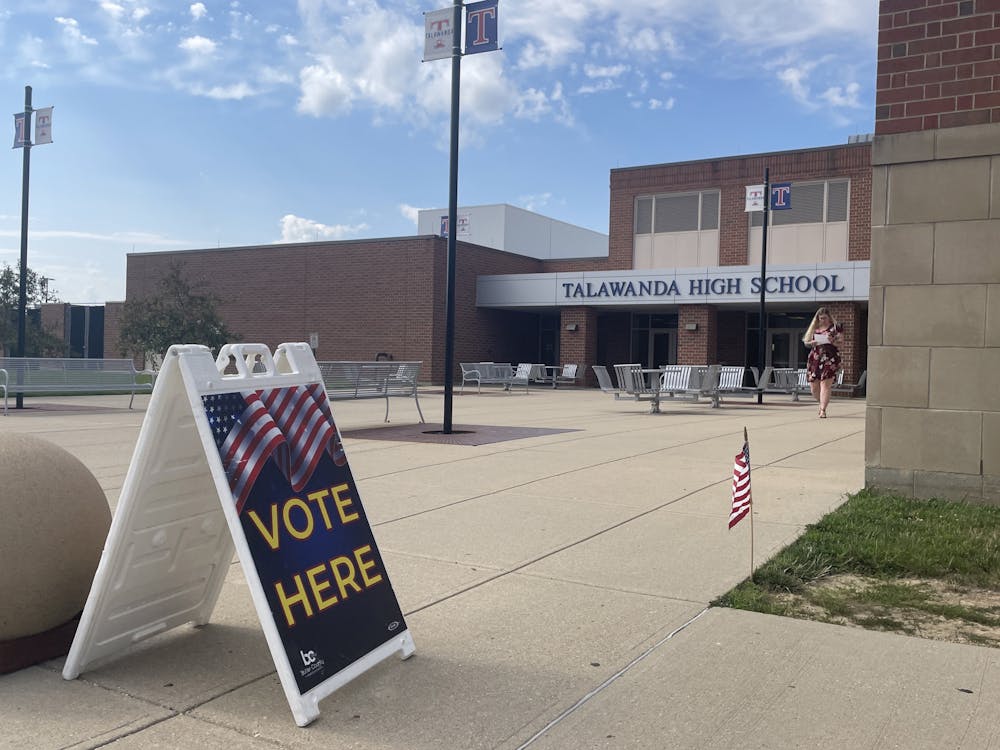

Separate from the city, the Talawanda School Board will also have to decide to forgo their portion of the increase or accept it.

A certain percentage of property taxes are allocated to schools, libraries and other local services, which can vary in price based on passed levies. Levies are measured in millage, which equals $1 for every $1,000 of taxable value.

In Ohio, some school districts are bound by the 20-mill floor. In Butler County, eight of the 10 school districts are at the floor, which is the state minimum, and 53% of county residents live in those districts.

Enjoy what you're reading?

Signup for our newsletter

The law states that school districts cannot collect less than 20-mills of the assessed value, even if this means the amount collected from property taxes increases.

Lakota and Fairfield are the only two school districts that are not at the 20-mill floor, which means residents living in the Talawanda School District will see a bigger tax increase.

Four townships beyond the City of Oxford pay property tax to Talawanda, including Hanover Township, Milford Township, Oxford Township and Reily Township.

Last year, Talawanda received more than $14 million in property taxes, which is determined by the county and filtered into the general fund or permanent improvement fund.

The general fund allocates money toward textbooks, equipment, teacher salaries, custodians, the busing system and more. The permanent improvement fund allocates money to two bond issues: the Talawanda High School construction project and the Bogan Elementary School construction project.

According to the school district’s website, in 2022, 67% of the funding for Talawanda schools was provided locally, primarily through property taxes. In 2021, the average cost of sending a student to school was $13,500.

Holli Hansel, Talawanda’s director of communications and public relations, said Talawanda only gets about $2,500 per student from the state. Additionally, she said they miss out on a large source of revenue because Miami University is tax exempt and owns a huge amount of land in the school district.

For public schools in Ohio, 60% of state funding comes from the value of the properties in the district, so if the values go up, the district receives less money.

“[Nix] is wanting us not to take money based on this increased evaluation, but at the same time, we risk losing money from the state because of the increased valuation,” said Pat Meade, president of the Talawanda School Board.

In December, the school board made a series of cuts that would save the district $5.3 million over the next three years, after an operating levy failed to pass in the November midterm election. If the school board were to accept the increase in property taxes, Matt Lynkins, the president of Talawanda’s teachers union, said they may be able to bring back or eliminate some of the cuts.

Additionally, this year, Talawanda teachers, administrators and staff members will not be getting an annual raise because of the district’s deficit.

Meade said that in 2021 teachers negotiated a three-year contract in effect from Aug. 1, 2021, to July 31, 2024. The contract stated that teachers would receive raises of 2% for the 2021-2022 school year, 1% for the 2022-2023 school year and 0% for the 2023-2024 school year.

“I think [the teachers’] motive was to show the taxpayers they were willing to sacrifice to be part of the solution to our economic problems,” Meade said. “I believe their hope was that the community would see their sacrifice and step up and pass the levy which did not happen.”

Lynkins said this structure of public school funding places too large a burden on property owners.

“There are people who have large swaths of property in this place, and they depend upon it,” Lynkins said. “I would never want a situation where people simply have to sell their family farm that has been in their family for generations, so that they can fund schools.”

In 1976, Ohio House Bill 920 froze property taxes at the amount of their original assessment. This means that as property values rose with inflation, the amount schools were given from property taxes remained the same.

Meade said the school board has not discussed whether or not they will accept Nix’s proposal, but the students will be at the forefront of the discussions.

“It’s for our students, and our students deserve a good education, and they deserve the community investing in them,” Meade said.

While both city council and school board will discuss the taxes and vote on a decision, their decisions are independent.

“Let’s just say Hanover declined the increase,” said Shaunna Tafelski, Talawanda’s treasurer. “It’s going to affect their local entity, but it will not affect Talawanda’s portion. Both entities would have to decline or accept.”

Meade has already calculated how much his property taxes would go up if both entities refuse Nix’s proposal, and while he disagrees with the increase, he argues there is an overarching problem targeted at the funding of school districts.

“I know that it can be somewhat of a hardship on people, and I understand that there is a certain percentage of the population that own property and their income is fixed, and it might be difficult, and I do have sympathy for that,” Meade said. “Unfortunately, the way the state funds schools, it puts a great majority of the burden on local taxpayers.”