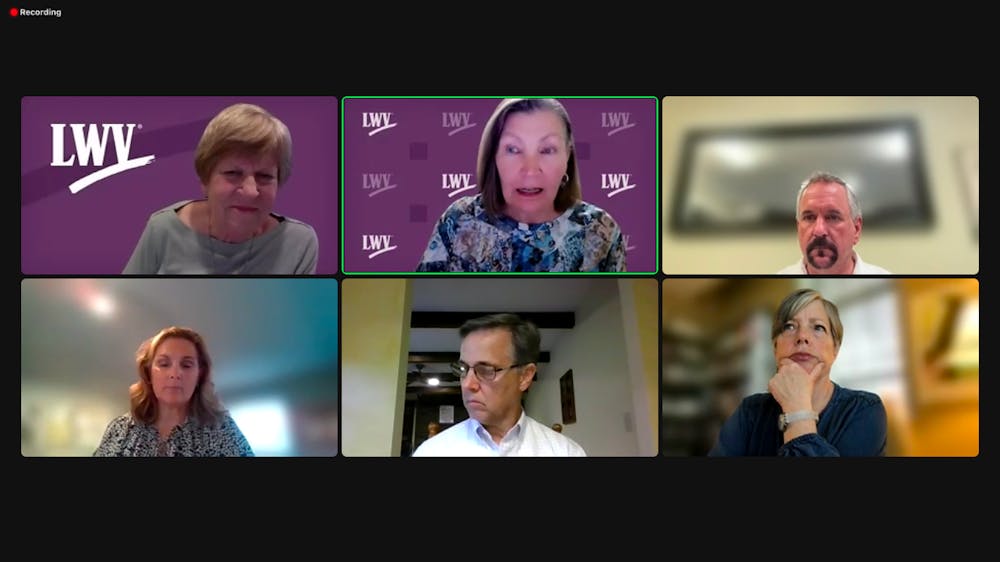

On May 8, the League of Women Voters of Oxford (LWV) hosted a virtual panel discussion with representatives from the Talawanda School District (TSD) to discuss budgetary constraints and associated cuts to the district.

Sandi Woy Hazleton, the co-president of the organization, moderated the discussion, and the panelists were Ed Theroux and Shaunna Tafelski, the superintendent and treasurer of TSD respectively, and Chris Otto and Kathleen Knight-Abowitz, members of the school board.

The panel began with an overview of the state funding model for public school districts in Ohio. This year, Tafelski said TSD is likely to bring in $38 million in revenue, with 73% coming from the community and the remaining 27% from state sources.

This year, Talawanda received $8.7 million from the state, the lowest amount of the seven school districts in Butler County, and the same amount it has received for the past 15 years.

“Our enrollment really hasn’t changed,” Tafelski said. “We’ve been basically stagnant between 2,800 and 3,000 students, yet their support keeps diminishing year after year. It’s not keeping up with inflation.”

The amount of funding TSD receives from the state is based on Ohio’s Fair School Funding Plan (FSFP), which looks at the property and income taxes of the area.

Tafelski said the property and income valuation of Oxford is high because it is home to Miami University. Since Miami is a public institution, it does not pay property taxes.

“Unfortunately, if we have a large amount of property exempt, it puts more of the burden on our community taxpayers because any public entity does not pay property taxes,” Tafelski said. “So it's pushing the burden out on the local community.”

Although the FSFP’s goal is to fairly allocate funds to school districts across the state, Tafelski said the model doesn’t fit TSD’s community.

“The base of the funding formula relies too heavily on real estate property taxes,” Tafelski said. “We’ve got agriculture, commercial, industrial and residential, and they use this one formula for all our students. It’s unconstitutional and continues to be.”

To help generate revenue to save the school district, TSD put a levy on the November 2022 ballot, which would have increased residents’ property taxes annually by $199.50 per $100,000 assessed value. The levy failed to pass with 66% of votes against it.

Enjoy what you're reading?

Signup for our newsletter

During the 2019-2020 school year, the state’s Attorney General Office did an audit of TSD and evaluated the cost and revenues of TSD, comparable school districts and property and income taxes. The office issued a list of recommended cuts the school district could make to save money. It cost TSD $60,000 to conduct the audit.

“We did that because we knew it was an investment,” Theroux said. “We recognized many years ago that our funding situation was in peril and that we needed to do something.”

The audit came back with recommendations to cut extracurricular activities, outsource custodial services, reduce bus routes, downsize staff and more.

At the Dec. 15, 2022, school board meeting, the members voted on a plan that would yield $5.3 million over the next three years. To reach this amount, TSD will hire fewer employees, reduce staff positions, eliminate busing, instate a pay-to-play fee for students in sports and band, cut extracurriculars and more.

“I want to be clear; $5.3 million will help us a lot, but it will not save us,” Theroux said. “[It] will push it out to about 2030, 2031, maybe even a year later, before we’re out of money.”

Theroux went over the three-year plan, but many audience members questioned if a levy would appear on an upcoming ballot.

“[The school funding system] is built so that we have to go back to voters, and we have to ask for a levy,” Knight-Abowitz said. “So the question is not if, the question is when.”

At the end of the panel, the representatives from TSD held a question-and-answer session with the audience members. One member asked if the levy would go up on the November 2023 ballot with other contentious political topics, such as abortion rights and reproductive care.

Theroux confirmed that levies have typically passed during more contentious elections when there are more voters, but did not confirm if the levy would be on the November ballot. Tafelski said she would be hesitant to put it to a vote so soon because there is currently an increase in property valuations going on in Butler County.

“I’m very concerned about putting something on a November ballot without knowing the full ramifications for our community members,” Tafelski said.

The LWVO and TSD will host another panel later this summer to discuss school funding at the state level with locally elected officials in the state legislature as the panelists.